tax break refund tracker

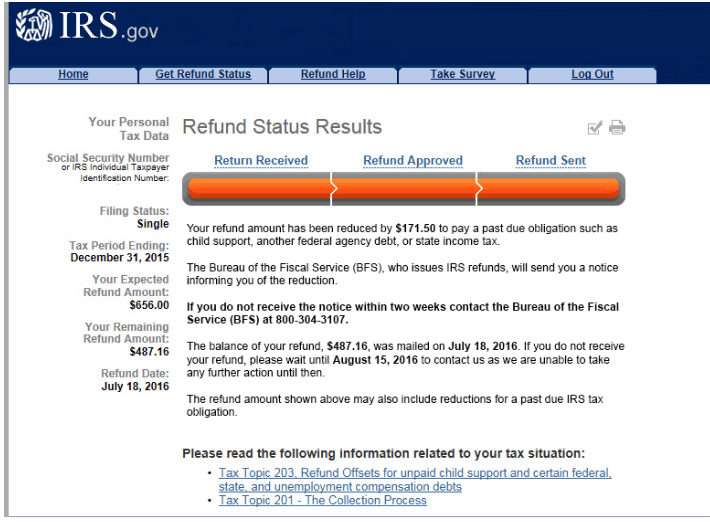

Your Social Security numbers. The IRS can seize the refund to cover a past-due debt such as unpaid federal or state taxes and child support.

Wayne Lippman Lippman Associates Wayne Lippman Lippman Associates Cpa S Inc Tax Refund Finance Debt Finance Saving

10200 x 022 2244.

. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. 22 2022 Published 742 am. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by.

The 10200 is the amount of income exclusion for single filers not the amount of the refund. Moving on to another example weve a person and they are single. The IRS will determine whether the check was cashed.

Online Account allows you to securely access more information about your individual account. Learn How Long It Could Take Your 2021 Tax Refund. One of the lesser-known provisions of the 19 trillion American.

Press 2 for questions about your personal income taxes. Press 1 for questions about a form already filed or a payment. WHILE there are 436000 returns are still stuck in the IRS system Americans are looking for ways to track their unemployment tax refund.

4 weeks after you mailed your return. Lets say they were on unemployment last year which means their income is somewhere between 9800 to 40000. You can ask the IRS to trace it by calling 800-829-1954 or by filling out and sending in Form 3911 the Taxpayer Statement Regarding Refund.

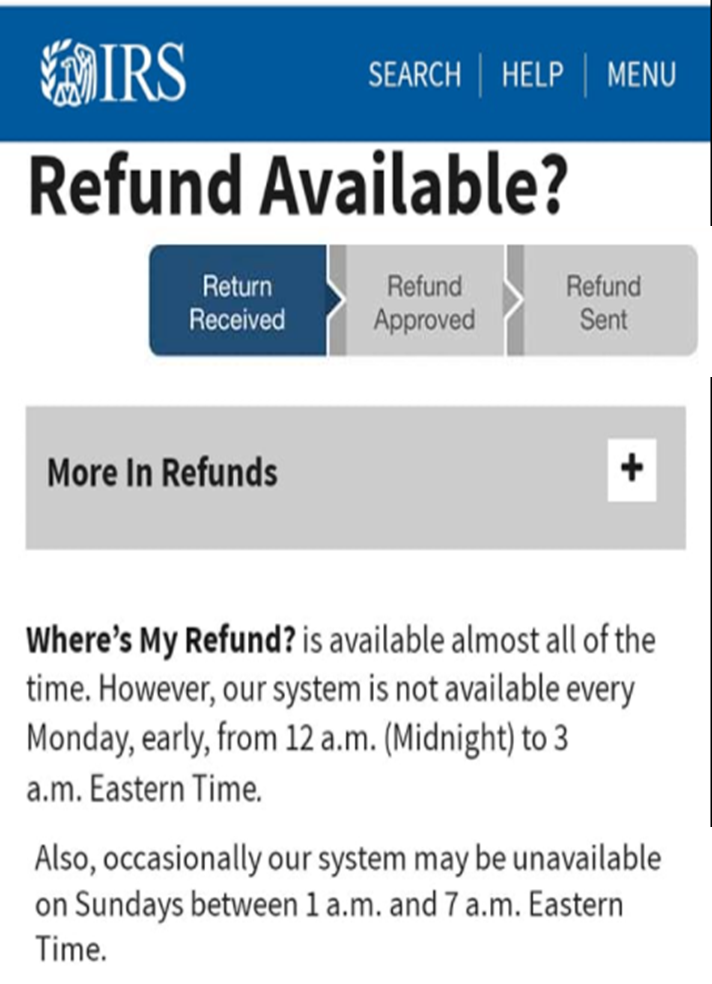

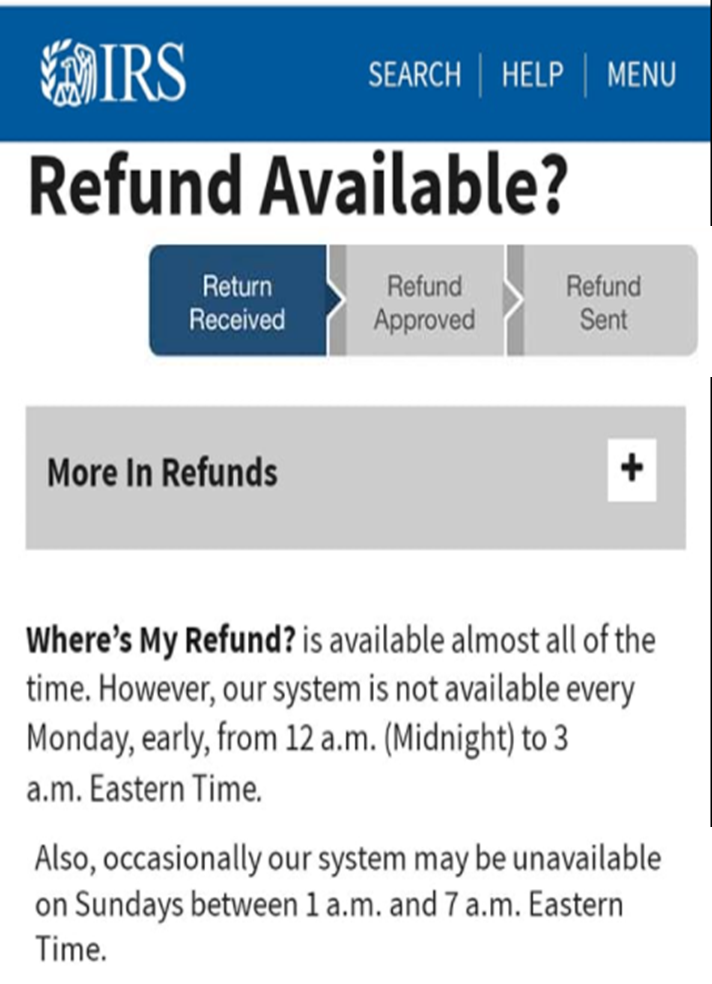

Ad See How Long It Could Take Your 2021 Tax Refund. The best way to check the status your refund is through Wheres My Refund. How to calculate your unemployment benefits tax refund.

Ad See How Long It Could Take Your 2021 Tax Refund. Tax Break Tracker is a database on governmental tax abatement disclosures. The agency said only call 800-829-1040 if its.

22 2022 Published 742 am. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. You had to qualify for the exclusion with a modified adjusted gross income of less than 150000.

Bank Account No and correct address is mandatory. Ad Learn How to Track Your Federal Tax Refund and Find The Status of Your Paper Check. You can try the IRS online tracker applications aka the Wheres My Refund tool and the Amended Return Status tool but they may not provide information on the status of your unemployment tax refund.

Check My Refund Status. Ad Easy and Efficiently Track and Manage all your Tax Filings and Projects in your Office. Lets track your tax refund.

So doing a little calculation gives us the following. Heres how to check online. The IRS can seize the refund to cover a past-due debt such as unpaid federal or state taxes and child support.

Your exact whole dollar refund amount. Viewing your IRS account information. Another way is to check your tax transcript if you have an online account with the IRS.

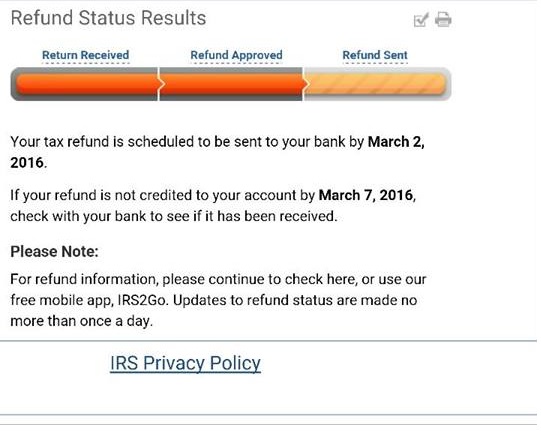

Can I track my unemployment tax refund. Will display the status of your refund usually on the most recent tax year refund we have on file for you. How To Track Unemployment Tax Break Refund.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in. Lets track your tax refund. Visit IRSgov and log in to your account.

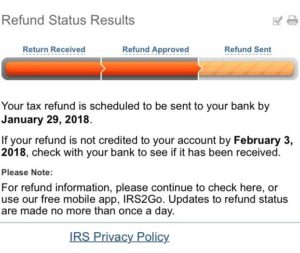

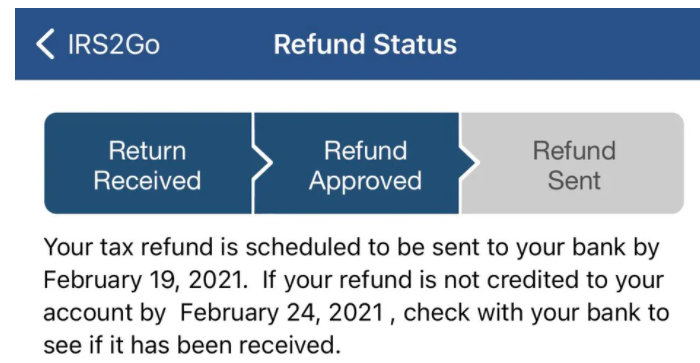

Unemployment Income Rules For Tax Year 2021. The IRS apps IRS2go can check your tax refund status but its updated overnight so check the next day if theres no change Credit. Calling the IRS at 1-800-829-1040 Wait times to speak to a representative may be long Looking for emails or status updates from your e-filing website or software.

All you need is internet access and this information. This is the refund amount they should receive. It will create a claims package that includes a copy of the endorsed cashed check if it was indeed cashed.

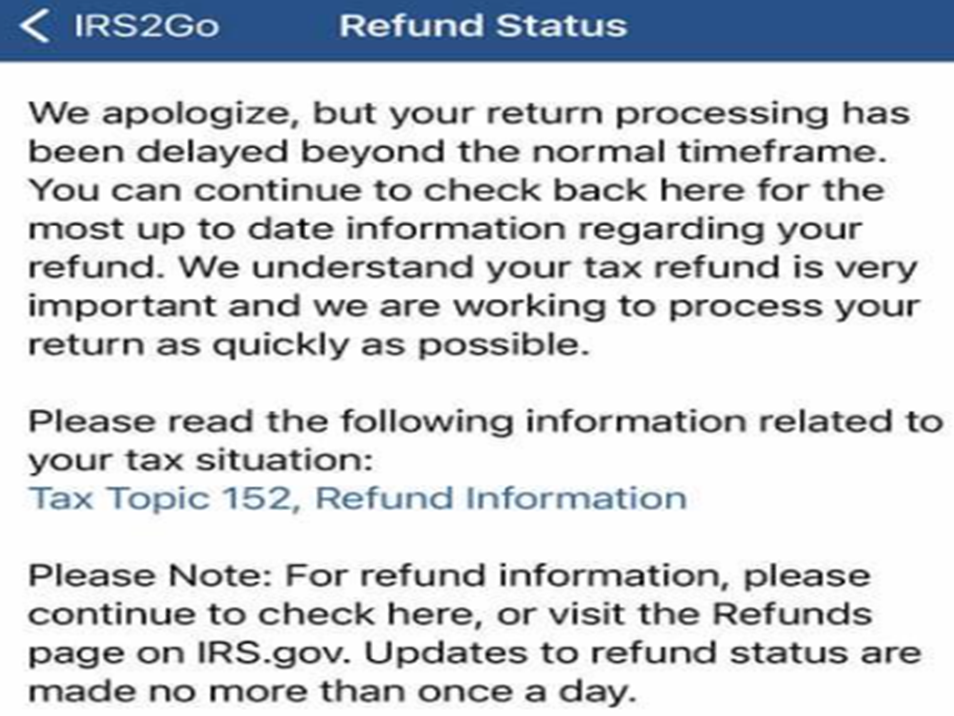

The amount of the refund will vary per person depending on overall income tax bracket and how. You wont be able to track the progress of your refund through the IRS Get My Payment tracker the Wheres My Refund tool the Amended Return Status tool or another IRS portal. Select your language pressing 1 for English or 2 for Spanish.

If you havent opened an account with the IRS this will take some time as youll have to take multiple steps to confirm your identity. Make sure you never miss another filing date and help your firm run smoothly. Press 3 for all other questions.

Using the IRS Wheres My Refund tool. Tracking your refund via the IRSS tracking tools is the best way to find out about the status and timeline because their phone lines are severely limited. You can start checking on the status of you return within 24 hours after the IRS received your e-filed return or.

The only way to see if the IRS processed your refund online is by viewing your tax transcript. When it went into effect on March 11 2021 the American Rescue Plan Act gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020. Call the IRS at 1-800-829-1040 during their support hours.

24 hours after e-filing. Recipients may not get a tax break this year which means they should take. How to speak directly to an IRS agent.

WHILE there are 436000 returns are still stuck in the IRS system Americans are looking for ways to track their unemployment tax refund. Check For the Latest Updates and Resources Throughout The Tax Season.

Where S My Refund Where S My Refund Status Bars Disappeared We Have Gotten Many Comments And Messages Regarding The Irs Where S My Refund Tool Having Your Orange Status Bar Disappearing This Has

Jyoupro Color Smart Fitness Tracker 0 96inch W Bp Bo Hr Heart Rate Monitor Fitness Tracker Plus Fitness Heart Rate Monitor

Increase Your Tax Refunds Tax Refund Tax Services Tax Help

Rental Income Tax Everything You Need To Know Fortunebuilders Rental Income Income Tax Income Tax Preparation

Wmr And Irs2go Updates And Status Changes Return Received Refund Approved And Refund Sent Aving To Invest

2022 Irs Refund Schedule And Direct Deposit Payment Dates When Will I Get My Refund Aving To Invest

11 Simple Ways To Lower Income Tax Better Prepare Earlier Than Later Money Habits Money Saving Tips Money Saving Mom

This Annual Tax Reference Guide Is For Any Business That Has Employee S And Contractors Or That Ha Bookkeeping Business Business Tax Small Business Bookkeeping

10 Other Great Online Websites For Income Tax Return Information Atkins E Corp Income Tax Income Tax Return Income Tax Preparation

Business Planner Printable Business Planner Pdf Business Etsy Business Checklist Business Plan Template Business Printables

Refund Status Where S My Refund Tax News Information

Refund Status Where S My Refund Tax News Information

Refund Status Where S My Refund Tax News Information

Wmr And Irs2go Updates And Status Changes Return Received Refund Approved And Refund Sent Aving To Invest

Wmr And Irs2go Updates And Status Changes Return Received Refund Approved And Refund Sent Aving To Invest

2019 Income Tax Filing Tips And Free Tax Organizer Atkins E Corp Tax Organization Financial Planning Saving Money Business Tax

Wmr And Irs2go Updates And Status Changes Return Received Refund Approved And Refund Sent Aving To Invest

How Tax Credits Work And Tax Credits To Consider Atkins E Corp Tax Credits Business Tax Deductions Business Tax